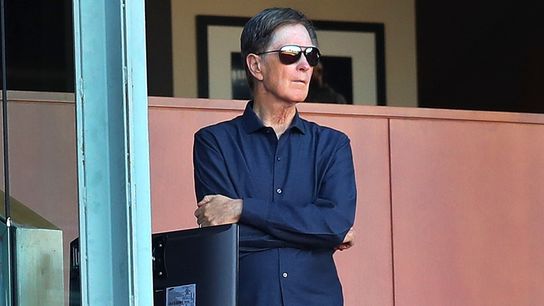

COLUMBUS, Ohio — For a man who exorcized the Curse of the Bambino in Boston and ended a 30-year English Premier League title drought in Liverpool, John W. Henry has little to say for himself.

Some sports owners crave the spotlight, making themselves visible to the public and available to the press. Henry, the patriarch of the Fenway Sports Group, which appears poised to purchase the Penguins, is more reticent. The 72-year-old son of soybean farmers would rather fill trophy cases than camera lenses.

Nobody will confuse Mario Lemieux for Jerry Jones, but the Penguins savior is far more animated than the American businessman and investor who rarely does interviews, preferring to correspond through emails.

“Mysterious,” said retired Boston Globe sports columnist Bob Ryan in describing the man who’s bankrolled four Red Sox World Series titles. “He’s an unfathomable person from the outside. He’s a very quiet, pensive, almost socially awkward owner. He’s clearly a bright man and you can’t fault him for what he’s accomplished.”

Much like Lemieux, who’s delivered five Stanley Cups to Pittsburgh as a player and a majority owner, Henry lets FSG’s run of success over two decades do the talking.

If and when the deal to buy the Penguins is finalized — Dejan Kovacevic reports the sale price to be $900 million — Henry likely will make the media rounds before receding into the background where he feels most comfortable.

The fact that he doesn’t like talking to reporters, but owns a major newspaper, the Boston Globe, is among several delightful contradictions. Henry is considered a sentimental sports owner, but has allowed a few of his biggest stars to leave in the name of good business. He revels in understatement, but counts the charismatic LeBron James as one of his FSG investors and the loquacious Jurgen Klopp as his Liverpool manager.

“There is a synergy that runs through his different assets,” said Sportico business writer Kurt Badenhausen, a former senior editor at Forbes. “Sports is in a lot of ways a relationship business. FSG has cultivated relationships with everybody, and that’s something that should benefit the Penguins long term.”

FSG is known for targeting iconic sports franchises and their venues. The Red Sox and Fenway Park. Liverpool and Anfield. Henry also heads New England's cable flagship station NESN and is a co-owner of the Roush Fenway Keselowski Racing team on the NASCAR circuit.

Details regarding FSG’s plans for the Penguins are scarce. Lemieux will remain as a minority owner to lend valuable expertise and continuity. There appears to be no looming changes to the team’s management and its coaching staff.

But plenty of intrigue surrounds the conglomerate and how it will operate the Penguins should the deal become reality. Pirates general manager Ben Cherington, who worked in the Red Sox organization, declined comment “for now,” through a team spokesperson. Pittsburgh native Larry Lucchino, a former Red Sox president-CEO, could not immediately be reached for comment Wednesday.

DK Pittsburgh Sports did, however, speak to seven sources who closely monitor FSG franchises to gain insight into how Henry and his fellow investors have become one the sports world’s most powerful ownership groups. The composite sketch reveals how they function in a “real economic world,” what mistakes have been committed along the way and where potential dangers lurk in spreading one’s self too thin.

“It does crop up in conversations,” said Simon Hughes, a Liverpool-based author and sports writer for The Athletic. “How on Earth is it possible to run massive institutions in different countries when you have an ocean separating them?”

____________________

GETTY

Liverpool FC celebrate its 2020 Premier League title.

In 2004, the Red Sox captured their first World Series title in 84 seasons. The triumph came just three years after Henry purchased the team and, along with Tom Werner and others, established New England Sports Ventures, which is now the Fenway Sports Group.

Fans wept in delight, some even visited the gravesites of parents and grandparents who did not live long enough to see the glorious day.

“What was the fan perception of the Red Sox before (Henry) took over,” Ryan asked rhetorically. “It was a baseball population that wallowed in self pity and I thought was the most narcissistic group of fans in America, thinking that nothing bad ever happened to anybody else. Just them.”

But ridding Boston of Babe Ruth’s ghost was light work in contrast to restoring Liverpool to the perch of English soccer. Once the nation’s most decorated club, Liverpool’s last top-flight championship had come in 1990.

Bitter rival Manchester United began collecting trophies with regularity. Meanwhile, new ownership at Manchester City and Chelsea started outspending everyone for top talent thanks to money that flowed endlessly from their natural gas and oil wells.

By 2010, when FSG purchased Liverpool, the storied club was in financial chaos due to the mismanagement of its former American owners, Tom Hicks and George Gillett, who ran up considerable debt.

“The club was at, arguably, its lowest ebb just prior to the sale to FSG,” Liverpool Echo business writer Dave Powell wrote in an email. “It was revealed by former (Liverpool) managing director Christian Purslow that the club was ‘days away from administration,’ (a financial mechanism that rescues a business and prevents it from going into liquidation.) . . . FSG made promises to pay that debt down and implement a new strategy and way of working, essentially building a successful business that could underpin success on the feel. That has largely been the case.”

FSG revived Liverpool over several years, leaning on the group’s hallmark formula: Identifying the right people and putting them in positions of leadership. It’s become a staple of Henry’s stewardship.

In Boston, Lucchino hired Theo Epstein and Terry Francona. In Liverpool, Mike Gordon recruited Michael Edwards and Klopp. Over the past three seasons, Liverpool has returned to prominence, winning the UEFA Champions League title in 2019 and the Premier League crown in 2020.

“(FSG’s) ownership of Liverpool has coincided with a new golden age,” wrote longtime ESPN soccer commentator Ian Darke in an email. “Whether that’s because of them or a very good coach in Jurgen Klopp is open to question. But they were smart enough to appoint Klopp.”

Circumstance in Pittsburgh are not nearly as dire. The franchise has a two-time Cup champion in Mike Sullivan behind the bench and a veteran management team in Ron Hextall and Brian Burke, who led the Penguins to a division title in their first season in charge.

But there will come a time when changes are required, and sources said FSG is not afraid to make big calls. It sacked Liverpool legend Kenny Dalglish in 2012, and two years later almost won the Premier League title under Brendan Rodgers.

“What they did at Liverpool was extremely impressive,” Badenhausen said. “They know what they know and they know what they don’t know. They weren’t going to come into a club like that and run roughshod over it.

“There was a lot of skepticism about another American ownership group coming into the Premier League. They were able to take a measured approach and find the right people to put in charge. It’s one of most critical things you can do as an investor. I would not expect them to come into Pittsburgh and blow up something that’s working extremely well — 15 straight playoff appearances. I can see them coming in and helping the club around the edges for the time being.”

____________________

The name Gerry Cardinale and his firm RedBird Capital Partners don’t mean much right now to Penguins fans. All the focus is on Henry and FSG, as it should be.

But the story of Cardinale and RedBird is important because it gives fans a window into how FSG runs its business. The group is always in search of partnerships that strengthen its core. In March, RedBird invested $735 million into FSG and, in doing so, gave Henry access to one of the shrewdest facilitators in the sports world.

“The deal is part of an ongoing strategic alliance between the two companies that will focus on the active pursuit of growth opportunities for FSG,” according to the release announcing the partnership.

Several months later, Henry’s group — with its new enterprise valuation set at $7.35 billion — entered into negotiations for the purchase of the Penguins.

“Gerry has an incredible track record in terms of building sports properties,” Badenhausen said. “He was one of the people behind the YES Network. RedBird has their hands in everything when it comes to sports properties. The RedBird investment provided Fenway with a significant amount of capital to go out and put it to use to buy a big-time sports property in the case of the Penguins. . . . Gerry is one of the ultimate behind-the-scenes operators when it comes to the sports business world.”

How can this benefit the Penguins? Think of all the potential partnerships in gambling and streaming services. The possibilities are endless in the hands of creative people with powerful connections.

“There is salary cap for players (in hockey), but you want your owners making investments outside of that,” Badenhausen said. “Technology has hurt some industries and enterprises, but sports franchises can take new technologies and incorporate them. Let’s say a sponsor comes to FSG and maybe they don’t find a fit for the Red Sox, but they say, ‘we have this hockey property, and if you’re trying to reach a younger demographic that’s tech savvy, you should talk to our hockey people.’”

____________________

GETTY

Growing up in Illinois and Arkansas, Henry loved baseball but he was rail-thin and asthmatic. He was never going to find fame on the local diamonds.

“I used to play APBA (table-top baseball),” Henry told ESPN in a 2002 interview. “When Bill James' first ‘Baseball Abstract’ (book) came out in the early 80s, I'm sure I purchased it. Also, around that same time ‘The Hidden Game of Baseball’ came out, and I was fascinated by that.”

Henry evolved into a mathematics wiz, becoming a hedge fund billionaire by studying algorithms to predict the future.

After purchasing the Red Sox, he hired James and they became the first big-market MLB club to invest heavily in analytics. The same pattern followed at Liverpool as Klopp warmed to the data-driven analysis of the team’s director of research Ian Graham.

“Analytics is massive at Liverpool,” Hughes wrote. “I’ll be the first to admit that when they first started using it, I was skeptical. But they were able to marry the analytics with Klopp’s tactical approach. It’s really worked well over the last three or four years.”

You see where this is heading, Penguins fans?

One data-driven hockey insider, texted: “The loss of (former Penguins director of analytics) Sam Venture was big, but now people are seeing this purchase as a possible massive infusion of analytical skill with the ability to apply (it).”

____________________

GETTY

The Red Sox celebrate their 2018 World Series title.

Ryan woke up Wednesday to news of the possible Penguins sale to FSG. He could almost hear the grousing around breakfast table as Red Sox and Bruins fans consumed the stories with their coffee and cereal.

Boston hockey fans, Ryan said, have bad memories of Ulf Samuelsson’s injurious hit on Cam Neely and Matt Cooke’s concussive blow to the head of Marc Savard. Now, the Red Sox owner is buying the Penguins? Talk about divided loyalties.

But Ryan acknowledged a bigger concern. One that might be shared in Boston, Liverpool and Pittsburgh. Can a sports empire grow too large to adequately support all of its properties?

“People already were worried about resources being diverted away from the Red Sox to Liverpool,” said Ryan, who still writes bi-weekly columns for the Globe. “So now they have another team in Pittsburgh?”

Hughes said there have been similar grumblings in Liverpool.

“Fans are very quick to follow what goes on in Boston,” he wrote. “They saw the Red Sox let a few star players leave and Liverpool fans have worried that could be coming their way. . . . (Liverpool) ended up selling off Luis Suarez to Barcelona, and invested the money appallingly in (bad) transfers.

“But fans realize FSG’s financial model is based on a real economic world. Everything they make with the sports clubs goes back into those sports clubs. They have never taken any money out of the clubs. So if FSG were to decide to sell those clubs, they would make their profit. They operate in the real world as opposed to some clubs with unlimited resources.”

Despite the recent on-field success, FSG is still trying to earn the trust of Liverpool fans after the fiasco involving the previous American owners. Henry has endured several public-relations setbacks in trying to raise additional revenue.

In 2016, fans staged a stadium walkout to protest a spike in ticket prices. After winning the Champions League, the club attempted to trademark the word “Liverpool” to cut out small-time independent vendors. And just this year, the franchise had planned to join a European Super League, which would have guaranteed automatic qualifications for the continent’s biggest clubs.

In each case, Henry publicly apologized for ownership’s greedy intentions.

“They wanted Liverpool to join the hated and discredited European Super League, which was basically still born in the face of widespread contempt from fans,” Darke wrote. “Bottom line: It is a business deal for them no matter how much they want it to look like an emotional marriage.”

On the balance, FSG has done more good than harm in Boston and Liverpool. They have won major trophies and have renovated beloved venues rather than sentencing them to dates with a wrecking ball.

“When the right owners come in, they can almost mean as much as a Cy Young Award-winning pitcher or a Super Bowl-winning quarterback,” said Richard Johnson, a New England sports museum curator. “We have been blessed here with great owners.”

FSG’s challenge in Pittsburgh is much different than in Boston and Liverpool. Ownership will try to maintain a title contender, not build one. There are no long-suffering Penguins fans except for the delusional ones. There’s no aging stadium to buttress. There’s also no fear of having to outspend the Yankees or Manchester City because of the presence of a salary cap.

“With FSG, you know what you are going to get,” Badenhausen said. “These guys are savvy operators and they have a proven track record across sports. Financially, they will make good investments.”

Henry may remain a mystery to Ryan and others, but nobody has been heard complaining during the Red Sox’s four championship parades since 2004.

“He’s clearly a good identifier of talent and he knows how to get the right people in place — that’s an executive skill,” Ryan said of Henry. "He’s a hard nut to crack, but there’s no questioning his business acumen.”

Just don’t ask Henry to discuss it.